เรียน ผู้ใช้งานทุกท่าน

ข้อมูลเว็บไซต์ที่ท่านเรียกดูนี้ ได้ถูกยกเลิกการใช้งานแล้ว ท่านสามารถเรียกดูข้อมูลที่มีการปรับปรุงใหม่ได้ที่ www.scbam.com

ขอขอบคุณผู้ใช้บริการทุกท่าน

บริษัทหลักทรัพย์จัดการกองทุน ไทยพาณิชย์ จำกัด

Dear users,

Please be informed that the Web contents you are trying to view have been removed. Please visit www.scbam.com for the updated version.

Thank you,

SCB Asset Management Co.,Ltd.

------------------------------

แนะนำการใช้งานเมนูเบื้องต้น

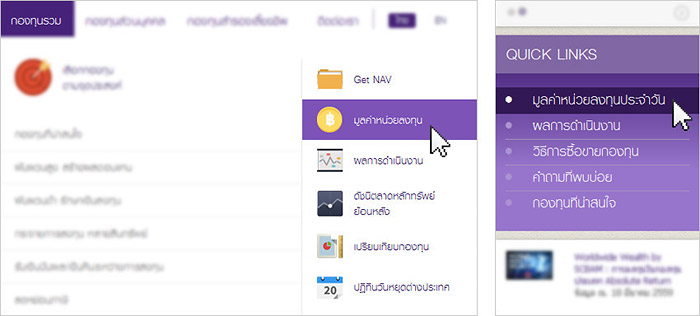

• หาข้อมูล "มูลค่าหน่วยลงทุน (NAV)" ได้จากที่ใด....

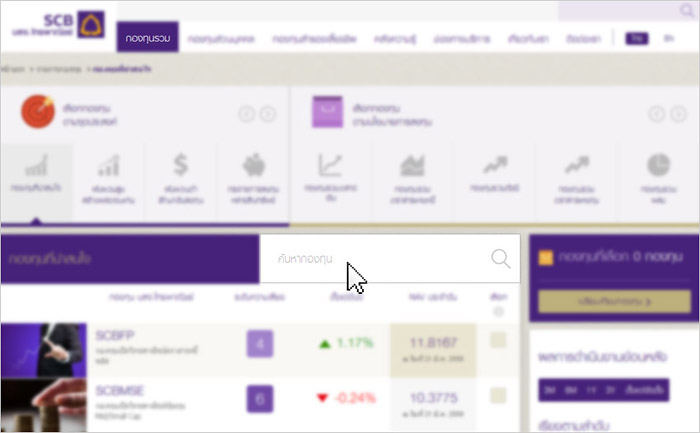

เข้าสู่เว็บไซต์ www.scbam.com บริเวณ Tab Menu ด้านบน เลือก > กองทุนรวม จะปรากฎ Menu ย่อยขึ้นมา โดยหัวข้อนี้สามารถเรียกดู

"มูลค่าหน่วยลงทุน" และ "ดัชนีตลาดหลัดทรัพย์" รวมทั้งขอรับ Nav ผ่านอีเมล ได้ที่เมนู Get NAV หรือเข้าได้จากเมนู Quick Links ด้านล่าง

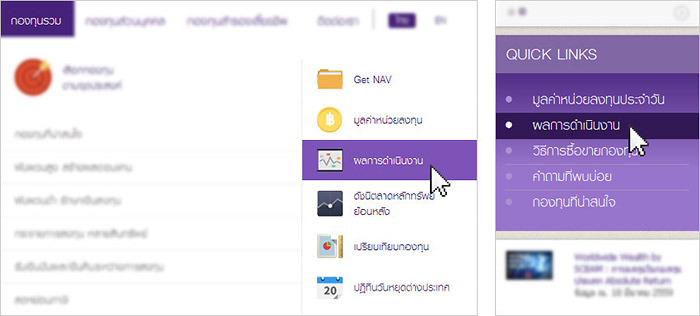

• หาข้อมูล "ผลการดำเนินงานของกองทุน" ได้จากที่ใด....

เข้าสู่เว็บไซต์ www.scbam.com บริเวณ Tab Menu ด้านบน เลือก > กองทุนรวม จะปรากฎ Menu ย่อยขึ้นมา โดยหัวข้อนี้สามารถเรียกดู

"ผลการดำเนินงาน" ซึ่งจะบอกผลการดำเนินงานย้อนหลังของกองทุนได้ หรือ "เปรียบเทียบกองทุน" ได้ หรือเข้าได้จากเมนู Quick Links

ด้านล่าง

• เรียกดู "ข้อมูลกองทุนรวม" ได้จากที่ใด....

เข้าสู่เว็บไซต์ www.scbam.com บริเวณ Tab Menu ด้านบน เลือก > กองทุนรวม จะปรากฏรายการกองทุนรวมต่างๆ และสามารถค้นหากองทุน

ได้ที่ช่อง "ค้นหากองทุน"

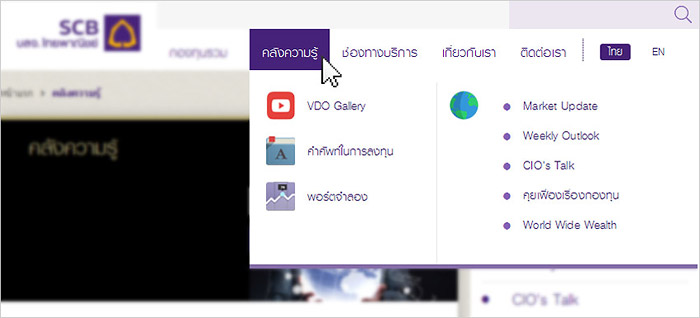

• หาข้อมูลเกี่ยวกับภาวะเศรษฐกิจ เพื่อประกอบการตัดสินใจลงทุนได้จากที่ใดบ้าง....

เข้าสู่หน้าเว็บไซต์ www.scbam.com บริเวณ Tab Menu ด้านบน เลือก > คลังความรู้ จะปรากฎข้อมูลการลงทุนต่างๆ เช่น VDO สอนลงทุน

คำศัพท์ต่างๆ บทความทางเศรษฐกิจ หัวข้อ Market Update, Weekly Outlook, CIO’s Talk, World Wide Wealth, คุยเฟื่องเรื่องกองทุน